Recommended contact person

Overview of Wills and Trusts in Cyprus

Will in Cyprus

A Will is a legal document that outlines how a person’s assets will be distributed upon their death. Under Cyprus law, a Will must be drafted in compliance with the Wills and Succession Law (Cap. 195) and must be executed properly to be valid.

Trust in Cyprus

A Trust is a legal arrangement where a Settlor transfers assets to a Trustee, who manages them for the benefit of specified Beneficiaries. In Cyprus, one may be eligible for setting up a Local Trust or the Cyprus International Trusts (CIT) Law of 1992 (as amended in 2012) governs international trusts, offering significant advantages in asset protection, tax efficiency, and estate planning.

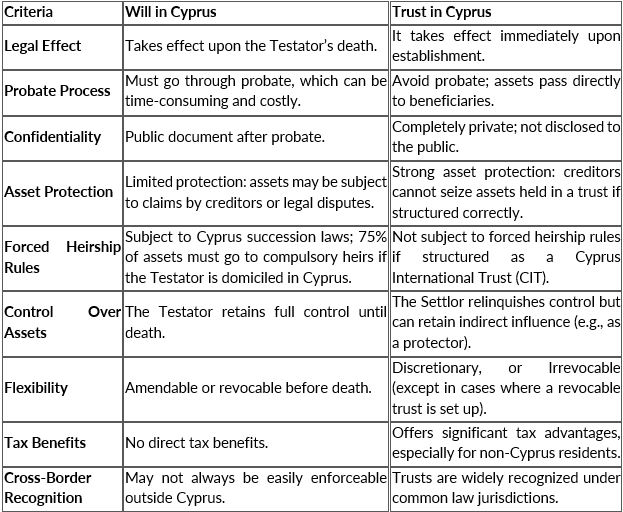

Key Differences Between a Will and a Trust

Advantages and Disadvantages of a Will vs. a Trust

Advantages of a Will:

- Simple to establish: A Will is straightforward to draft and execute.

- Lower initial cost: Generally cheaper to create compared to setting up a trust.

- Flexibility: Can be modified any time before death.

- Full control: The Testator retains control over assets during their lifetime.

Disadvantages of a Will:

- Probate delay: Distribution of assets can take months or years.

- Public record: Once probated, a Will becomes public.

- Forced heirship: In Cyprus, a Will is subject to forced heirship rules unless the Testator is non-domiciled.

- Risk of disputes: Wills are more frequently challenged in court.

Advantages of a Trust:

- Avoids probate: Ensures immediate and seamless transfer of assets to beneficiaries.

- Confidentiality: Trusts remain private and do not become part of public records.

- Asset protection: Protects assets from creditors, divorce claims, and legal disputes.

- Tax efficiency: Cyprus International Trusts provide favorable tax treatment for non-Cyprus residents.

- No forced heirship: A properly structured trust can bypass Cyprus’ forced heirship rules.

- Cross-border effectiveness: Easier to enforce internationally, particularly in common law jurisdictions.

Disadvantages of a Trust

- Higher setup and maintenance costs: Establishing and managing a trust is more expensive than writing a Will.

- Reduced control: The Settlor must relinquish ownership of the assets to the Trustee.

- Complexity: Requires careful legal structuring and professional management.

When to Choose a Will or a Trust?

A Will is preferable if:

- The estate is relatively simple, with assets only in Cyprus.

- The individual wants to retain full control of assets during their lifetime.

- The primary concern is inheritance distribution rather than tax planning or asset protection.

- Forced heirship rules are not an issue (e.g. for non-domiciled persons).

A Trust is preferable if:

- The individual seeks confidentiality, asset protection, and tax efficiency.

- The assets include international holdings or complex financial structures.

- The estate owner wants to bypass probate delays and forced heirship rules.

- There is a need to structure long-term wealth management, such as providing for minor children or protecting assets from family disputes.

Conclusion: Which One is Better?

There is no one-size-fits-all answer. The decision depends on the individual’s priorities.

- If simplicity, low cost, and control are paramount, a Will is the better option.

- If privacy, asset protection, tax efficiency, and avoiding forced heirship are the goals, a Trust is the superior choice.

For high-net-worth individuals with international assets, a Trust is often the optimal solution. However, for those with local assets and straightforward estate plans, a Will may suffice.

Hybrid Approach

For a comprehensive estate plan, a combination of both may be advisable:

- Use a Trust to hold substantial or complex assets (real estate, business shares, offshore holdings).

- Use a Will to distribute personal effects, local bank accounts, and any residual assets.

AGPLAW – Trusts, Wills & Probate

Contact AGPLAW’s expert team at agp@agplaw.com

The information provided in this document/article is for general informational purposes only and should not be considered legal or professional advice. While every effort has been made to ensure the accuracy and reliability of the information contained herein, the author, publisher, or any related parties make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information. Any reliance you place on such information is therefore strictly at your own risk. In no event will the author, publisher, or any related parties be liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this document/article. It is recommended to seek independent legal advice for any specific legal concerns or decisions.