Recommended contact person

Introduction

In an increasingly interconnected world, individuals and businesses are continuously seeking ways to protect, manage, and grow their assets across borders. One of the most effective and time-tested mechanisms for achieving these goals is the establishment of a trust. Among the various international jurisdictions that offer trusts, Cyprus has emerged as a leading destination, thanks to its favorable legal framework, tax incentives, and international reputation. The Cyprus International Trust (CIT) stands out as a premier tool for estate planning, wealth management, and asset protection for both individuals and businesses.

In this article we intent to analyse the concept of the Cyprus International Trust, aiming at explaining its key features, roles, benefits, and applications. We will also take a closer look at why Cyprus has become such a desirable location for establishing international trusts, particularly for high-net-worth individuals, multinational corporations, and other entities seeking to protect and grow their wealth.

What is a Cyprus International Trust?

A Cyprus International Trust (CIT) is a legal arrangement that allows a person (the settlor) to transfer ownership of assets to a trustee, who manages these assets for the benefit of designated beneficiaries. Trusts in Cyprus are governed by the Cyprus International Trust Law of 1992, which was amended in 2012 to further enhance its attractiveness to foreign investors.

Cyprus International Trusts are considered particularly advantageous for foreign investors because they allow for flexibility in managing assets and offer strong legal protection. One of the defining features of the CIT is that neither the settlor nor the beneficiaries need to be Cypriot residents, allowing for a global reach and appeal. The only residency requirement is that at least one trustee must be a permanent resident of Cyprus.

Key Features of a Cyprus International Trust

Asset Protection

One of the most compelling reasons to establish a Cyprus International Trust is the unparalleled asset protection it provides. Once assets are placed in a CIT, they are effectively shielded from creditors, legal claims, and even future changes in the settlor’s personal circumstances.

In Cyprus, assets transferred to a trust cannot be claimed by creditors after two years of their transfer. This means that creditors who seek to make claims against a settlor after assets have been placed into the trust are limited by a strict two-year time frame. After this period, the trust is largely impenetrable, barring cases of proven fraud or intent to deceive creditors at the time of transfer.

Tax Efficiency

A key reason why many individuals and corporations choose to establish a Cyprus International Trust is the potential for significant tax benefits. Cyprus offers a tax-neutral environment for trusts, with the following tax advantages:

- Income earned from sources outside of Cyprus is not taxed in Cyprus.

- Dividends, interest, and other income from non-Cypriot sources can be accumulated and distributed without tax implications in Cyprus.

- There are no inheritance or estate taxes in Cyprus, making it an ideal jurisdiction for wealth transfer across generations.

These tax incentives make Cyprus an attractive option for multinational businesses, high-net-worth individuals, and families seeking a tax-efficient way to manage their wealth globally.

Confidentiality and Privacy

Cyprus law ensures a high degree of confidentiality for International Trusts. Trust documents are not required to be registered with any authority, and the identities of the settlor, trustees, and beneficiaries are not publicly disclosed. This ensures privacy for all parties involved, making Cyprus International Trusts an attractive option for individuals who wish to maintain discretion about their financial arrangements.

Furthermore, Cyprus adheres to strict professional secrecy laws, which means that any breach of confidentiality by trustees, lawyers, or other professionals involved in the management of the trust can result in severe penalties.

Flexibility and Control

Another significant benefit of a Cyprus International Trust is its flexibility. A settlor can retain a level of control over the trust, including the ability to change trustees, modify trust terms, or even revoke the trust in certain circumstances. Additionally, the trust structure can be adapted to suit the specific needs and goals of the settlor, making it ideal for:

- Family wealth management

- Succession planning

- Protection of vulnerable individuals (such as minors or incapacitated beneficiaries)

- Philanthropic purposes

This flexibility is key for individuals who wish to ensure that their assets are managed in a way that aligns with their long-term objectives.

Perpetuity

Unlike many other jurisdictions where trusts are limited in duration, a Cyprus International Trust can last indefinitely, ensuring long-term asset protection and management across generations.

This makes it an excellent choice for families seeking to establish multigenerational wealth preservation plans.

Roles in a Cyprus International Trust

In a Cyprus International Trust, several key roles are integral to the establishment, management, and operation of the trust. Below is a breakdown of these roles and how they interact:

Settlor

The settlor is the individual or entity that creates the trust. The settlor transfers assets into the trust and establishes the terms under which the assets are to be managed and distributed. While the settlor can retain certain powers (such as the ability to appoint new trustees or modify the trust), they generally relinquish direct control over the assets once they are placed in the trust.

Under the Cyprus International Trust law, the settlor cannot be a resident of Cyprus in the year preceding the establishment of the trust, though this rule allows international flexibility.

Trustee

The trustee is the individual or entity responsible for holding and managing the assets within the trust, as well as ensuring that the trust operates in accordance with its terms. Trustees in Cyprus are required to act in the best interest of the beneficiaries, adhering to fiduciary responsibilities. At least one trustee must be a Cyprus resident.

The trustee’s duties include:

- Investment management of trust assets

- Distribution of income or capital to beneficiaries

- Maintaining proper accounts and records of the trust

In some cases, a corporate trustee is appointed, particularly for larger or more complex trust arrangements.

Beneficiaries

Beneficiaries are the individuals or entities that are entitled to benefit from the trust. The trust deed defines who the beneficiaries are, and they may receive income, capital, or other benefits from the trust as outlined by the settlor.

Beneficiaries can be:

- Fixed: A specific group of individuals named in the trust deed.

- Class: A class of individuals, such as blood related relatives to the Settlor.

- Discretionary: Individuals who may benefit at the discretion of the trustees.

In a Cyprus International Trust, neither the settlor nor the beneficiaries are required to be Cypriot residents, adding to the flexibility of the CIT for international families and businesses.

Protector

In some cases, the settlor may appoint a protector. The role of the protector is to oversee the trustees and ensure that they are managing the trust in accordance with the settlor’s intentions. The protector typically holds certain powers, such as the right to remove or replace trustees, or to veto certain trustee decisions.

This role adds an additional layer of oversight and assurance for the settlor, especially in complex trust arrangements or when the trust is intended to last for multiple generations.

Manager or Investment Advisor

A manager, or investment advisor, may be appointed to oversee the investment strategy of the trust. While the trustees remain ultimately responsible for the management of the trust’s assets, the manager provides expertise in managing the financial portfolio. The appointment of a manager is particularly useful in cases where the trust holds significant or complex financial investments.

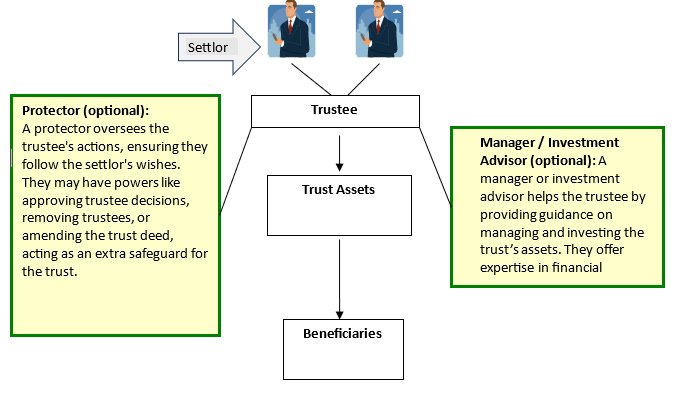

How a Cyprus International Trust Operates: A Diagram

Below is a simple diagram that illustrates how the key roles in a Cyprus International Trust operate:

This diagram visually represents the flow of responsibilities and interactions within a Cyprus International Trust. The settlor creates the trust by transferring assets to the trustee, who manages the assets. The protector can oversee the trustee’s actions, while the manager advises on investment decisions. Ultimately, the beneficiaries receive benefits from the trust in accordance with the terms laid out by the settlor.

The Legal Framework Governing Cyprus International Trusts

The legal structure of a Cyprus International Trust is primarily governed by three key pieces of legislation:

- The Cyprus International Trust Law of 1992 – This law establishes the fundamental principles governing CITs, including the rules around settlors, trustees, and beneficiaries.

- The Trustees Law, Cap 193 – Based on English trust law, this legislation outlines the responsibilities and duties of trustees in managing the assets held in trust.

- The Amendments of 2012 – These amendments enhanced the original 1992 law, making Cyprus one of the most attractive trust jurisdictions in the world. Key improvements included stronger asset protection provisions, more favorable tax treatment, and enhanced flexibility for trustees and settlors.

Why Choose Cyprus for International Trusts?

Cyprus offers a combination of favorable legal structures, tax benefits, and professional expertise that makes it an ideal jurisdiction for establishing international trusts. With solid asset protection mechanisms, a favorable tax environment, and highly experienced professionals, Cyprus continues to attract individuals and businesses from across the globe.

Conclusion

The Cyprus International Trust provides a powerful and flexible vehicle for individuals and businesses to protect, manage, and transfer wealth. By understanding the roles of the settlor, trustee, protector, and beneficiaries, as well as the flexibility and tax benefits that come with such a trust, you can make informed decisions to secure your financial future across generations.

AGPLAW, through its trustee entity AGP Trustees Ltd, has been offering professional trustee services since 2006. Mr. Paphitis, the director of trustee operations at AGPLAW, is a holder of the TEP title and a full member of the Society of Trust and Estate Practitioners (STEP) since 2005. STEP is a global professional association for practitioners who specialize in family inheritance and succession planning. Being a full member of STEP signifies a high level of expertise and professionalism in the field, as it requires rigorous qualifications and adherence to strict ethical standards.

This membership ensures that AGPLAW’s clients receive services from a highly qualified professional with a deep understanding of trust and estate matters.

For all enquiries please contact our team of experts at agp@agplaw.com

Cyprus International Trusts – Can Trustees be Removed or Replaced?

Disclaimer:

This article is intended for informational purposes only and does not constitute legal, financial, or tax advice. While every effort has been made to ensure the accuracy of the information provided, readers are encouraged to consult with AGPLAW to address specific questions or concerns related to Cyprus International Trusts or any other financial matters. Establishing a trust involves significant legal and financial considerations, and professional guidance should always be sought before making any decisions.